The UK Government has launched the Coronavirus Job Retention Scheme, which is the most comprehensive and ambitious economic intervention the country has ever seen.

The purpose of the scheme is to support employers to continue paying employees that would have otherwise been laid off as a result of the economic downturn caused by COVID-19.

Continue reading for the answers to questions you may have regarding this complex and wide-reaching scheme.

How does my organisation make a claim under the scheme?

You can apply for the scheme here: www.gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

Claims can be backdated to 1 March 2020, as long as the employees you are claiming for have done no work for your company during the period claimed for.

Any entity with a UK payroll can apply, including businesses, charities, recruitment agencies, and public authorities.

A worker must be furloughed for a minimum of three weeks. The scheme will last until the end of October.

The Government has confirmed that if your employment contracts allow employees to work for others whilst employed by your company, then they can work for another organisation whilst being furloughed. However, furloughed employees must not do any work for your company whilst they are furloughed – this includes associated or linked organisations.

In order to make a claim, you will need to provide the following information:

- A Government Gateway ID and password

- Your company’s bank account number and sort code

- The name and phone number of the person making the claim

- The amount claimed for

- The number of employees being claimed for

- The claim period (start and end date)

- Your company’s ePAYE reference number

Employers with fewer than 100 staff will be required to submit the details of each furloughed employee individually. Organisations with more than 100 staff will need to upload a consolidated file.

If an employee is placed on furlough, then it must be confirmed in writing as it is a change to their contract of employment. It’s a good idea to upload a copy of the letter to the employee’s record and retain it there for five years so that HMRC can verify, if needed.

Does furloughing employees mean that my company can’t make them redundant?

The Government has stated that when the scheme comes to an end – whenever that may be – your company will have to decide whether to welcome employees back to work, or whether to lay them off permanently.

There is currently no guidance on whether or not employers can make furloughed employees redundant, however, we believe that such cases will be rare.

What exactly is covered under the Coronavirus Job Retention Scheme?

Employers can claim a grant of 80% of an employee’s regular salary, up to a maximum of £2,500 per month, whichever is lower. The scheme will cover employees who were on payroll from 19th March 2020 onwards.

Commission can be included in the calculation for pay, as can overtime. However, the 80% of salary does not include non-monetary benefits such as health insurance or company car payments.

You can also claim the employer’s national insurance contributions and the employer’s minimum pension contributions.

If your company wishes to do so, they can top-up the 80% of furloughed employees’ salaries to pay them in full, however, this is optional.

In addition, the salary of each furloughed employee will still be subject to income tax and other normal deductions.

Upcoming changes

From 1 July, ‘flexible furlough’ is being introduced, which means furloughed employees will be allowed to return to work part-time without a risk of losing out financially. The Government has also added that this was due to businesses asking for greater flexibility to get staff back to work.

The scheme will close to new entrants on 10 June 2020 – so if you haven’t furloughed employees by then, they won’t be able to access the scheme and you can’t put them on furlough later.

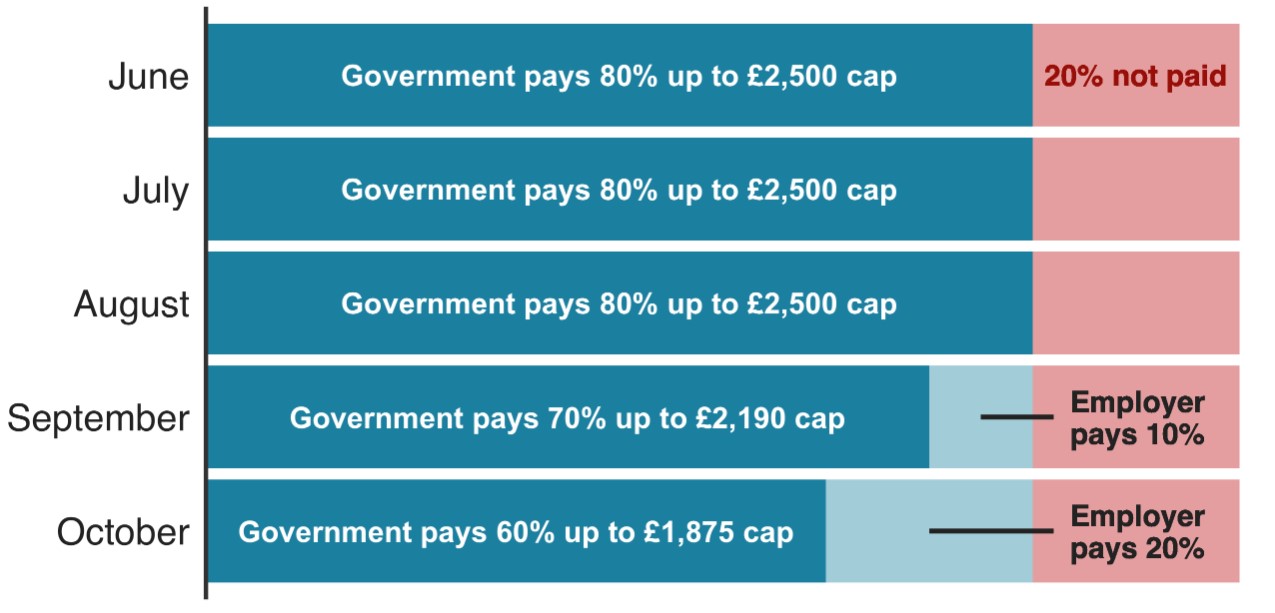

From August, employers must pay National Insurance and pension contributions, then 10% of pay from September, rising to 20% in October. The employer payments will substitute the contribution the Government is currently paying, ensuring staff continue to receive 80% of their salary, up to a maximum of £2,500 per month.

From October, the grant will decrease to 60% of salary, up to a maximum of £1,875 per month.

The scheme will come to an end completely on 31 October.

This graphic outlines the percentage breakdown of wages for furloughed workers from June to October:

Are employees who are off sick or are shielding eligible for the scheme?

Employees that are currently on sick leave should be paid the Statutory Sick Pay (SSP), or their contractual sick pay, for the duration of their ailment. If their sickness comes to an end, they can subsequently be placed on furlough.

The CJRS is not meant to include employees who are on short-term sick leave.

However, workers who are on long-term sick leave or are shielding can be placed on furlough. Employers cannot recover SSP from furloughed employees, though.

What about employees on any other leave, such as maternity?

For employees on other types of leave, such as maternity or paternity leave, the normal rules apply. They cannot be furloughed.

Are employees who are on unpaid leave eligible for the scheme?

Yes, as long as those employees were placed on unpaid leave on or after 19th March 2020.

Can my company re-hire staff and place them on furlough?

Yes, you can re-hire staff as long as they were on your payroll on 19th March 2020. However, employees cannot be re-hired and furloughed if they are being furloughed by a new employer.

Can employees take annual leave if they are furloughed?

HMRC has issued advice that employees can take annual leave if they have been furloughed.

Are we able to rotate which employees are furloughed?

In short, yes. A furloughed employee needs to be furloughed for a minimum of three weeks, but there is nothing stopping you from rotating employees between periods of work and periods of furlough, as long as the three-week minimum duration is adhered to.

How do I calculate the salaries of employees that work irregular hours?

You have to work out said employees’ monthly salaries. For example, an employee with irregular hours who has worked for your company for a full 12-month period before the claim, you would use the higher of the following:

- the employee’s earnings from the same month in the previous year; or

- the employee’s average monthly earnings from the 2019/20 tax year

We hope this guide answers any questions you may have regarding the Coronavirus Job Retention Scheme. If you have queries about how to process furloughed employees in your HR system, then we’ve created a separate guide to help you. Or, if you wish, you can get in touch with us – we’re always happy to help.